KEY TAKEAWAYS

- B2B fintechs could be sitting on a trove of internal data for stories

- Interesting data can fuel original, shareable content

- Highlighting financial trends may help build fintech reputations.

Data storytelling is hard.

You need to find the facts, stats, and trends in the first place — and then you need to know how to turn this data into an interesting and accurate story.

Done well, data storytelling can shine a light on issues and break them down in a way a layperson can understand.

What Good Data Storytelling Looks Like

Take these two recent examples.

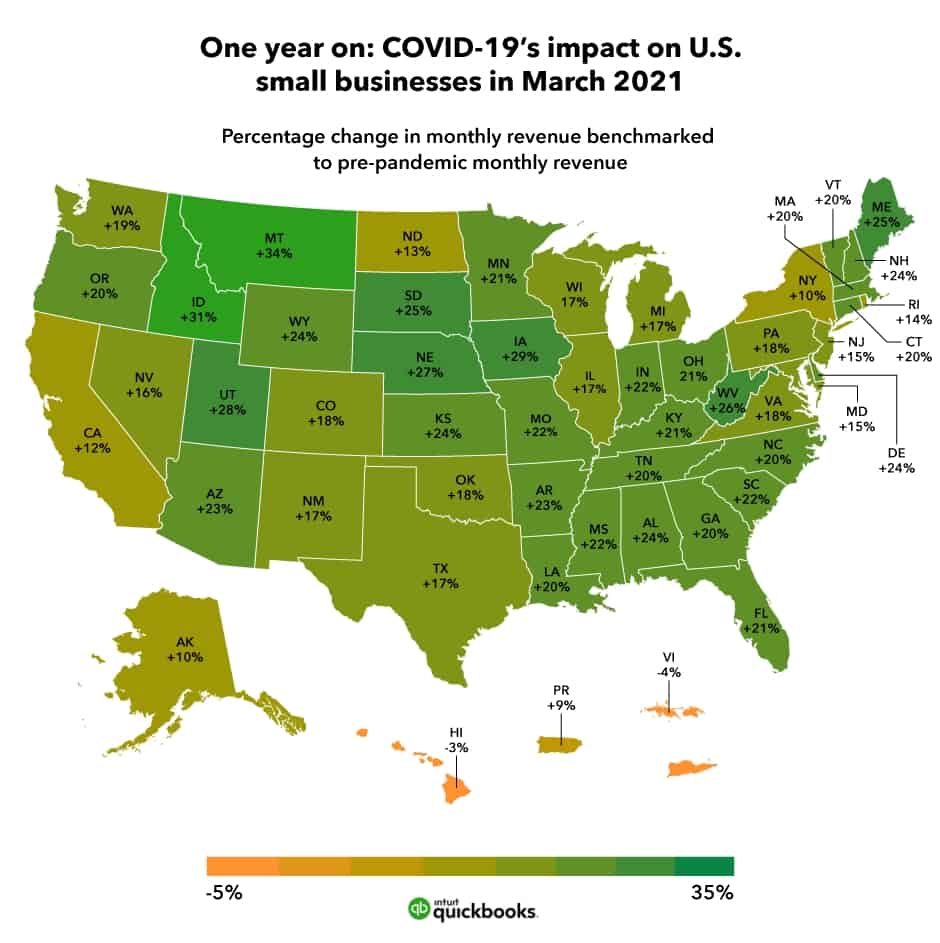

Data from Quickbooks data US small business revenue. Accounting software Intuit explained how the pandemic hit small businesses — and the slow climb of revenues since.

Grab’s Singapore travel data. Super-app Grab used more than six years of data to reveal how often Singaporeans book overseas travel and the popular destinations they visit. With an interactive site, Grab also let the audience explore the data for itself.

So why aren’t more fintechs publishing data stories in this way?

Read more: What 26 Finserv Brands Can Teach You About Content

Common B2B Fintech Publishing Approaches

Fear of the risks is probably the shortest answer.

And there’s more to it.

Many B2B fintech companies have solo or small marketing teams, responsible for an unmanageable amount of work. In this environment, content marketing programs are typically set up in just a few ways:

- High-volume publishing: Producing lots of surface-level articles, videos, or low-value lead magnets in the hope volume will win the day.

- Rank-obsessed publishing: Putting too much emphasis on rankings and keywords, in an endless race to outguess Google algorithms.

- Competitor-led publishing: Mimicking competitors, which creates a ‘sea of sameness’ for audiences who browse content across companies in the same industry.

Yes, some ‘data’ may be used in the approaches above. But it’s often sourced from ‘stat farms’ like eMarketer or Statista, instead of from in-depth original research.

Read more: How Fintech Marketers Can (Easily) Update Old Blog Posts

Scenarios That Prevent Fintechs Publishing Data Stories

Other roadblocks prevent true data-based storytelling. These are three commons scenarios:

- Not knowing where to look. This can often be the classic case of not seeing the wood for the trees. Fintechs don’t have to engage an external market research company to source interesting data. Customer surveys, internal analytics reports, and website and app data are all potential sources of data stories.

- Lacking journalistic skills. The fintech has lots of data, but overworked marketers do not know how it can be turned into a narrative that will interest wider audiences. This can often result in data lite stories that create a ‘so what’ response from audiences.

- Quick win cultures. Detailed data stories take persistence and patience — and it can be difficult to win support for this in a fast-paced startup or scale-up environment. It’s even more difficult if management wants immediate ROI from content marketing.

The effort of data-based story creation can yield a greater impact than other aspects of a content marketing program.

The newsletter's Coming Soon.

Subscribe for fintech content tips and insights.

PR Benefits of Data Storytelling for B2B Fintechs

Think about it. Internal fintech data is low-hanging fruit.

Your competitors do not have this data.

You have the luxury of spending time on it, to present it in a compelling way.

And data stories have potential beyond your owned channels.

Take Google’s COVID-19 Community Mobility Reports as an example. They show how people are moving around in different locations throughout the pandemic. This is a recent report for the state of New South Wales, in Australia:

Journalists love this kind of clear, quotable information — as this Bloomberg mention shows.

Read more: Why B2B Fintechs Should Tell Stories Like Nike

9 Tips for Original Data-Driven Fintech Content

Creating data-driven content shouldn’t be daunting. These tips might help:

- Explore internal data. Look at how customers are using your products and, see if usage volume has changed.

- Decide if it’s valuable. Ask if audiences will really care. And make sure it hasn’t been done already. And don’t forget to make sure you’re legally and ethically able to publish the data.

- Find the new angle. Look for patterns, demographic trends, or peaks and troughs in usage. See if the data disproves a commonly-made claim or challenges a widely accepted truth.

- Set measurable goals. Common goals include media coverage, high domain authority backlinks, subscribers, and lead generation.

- Prioritize. Struck gold? Resist the temptation to fit all data into one story. Set a clear message based on what the data shows.

- Show your methods. Not all data is equal. It’s important how it was gathered, how much was gathered, and how it is interpreted. Research rigor matters and transparency is important.

- Connect the dots. Use striking charts, graphs, or visualizations to bring the most powerful data to life. And look at how you can further explain what data means. For example, a fintech that provides payments technology could be able to identify the decline of certain product categories through ecommerce transaction data. Or a fintech that provides financial management software may be able to forecast which industries are experiencing the brunt of cashflow problems throughout the pandemic.

- Think in pictures. Reams of text rarely bring data to life. Use graphs, charts, animations, and interactive features to make data easier for audiences to grasp.

- Make it human. Data is undeniably powerful. But don’t forget audiences ultimately relate to other people. Find the emotional core of the data and look for ways to bring impersonal statistics to life through supporting profiles, interviews, and photography.

The most powerful data-driven stories use data as a resource, not a crutch.

Outshining Competitors With Data Stories

The B2B fintechs that tell interesting data stories will stand out above those who pursue content programs that rely mostly on search, over-publishing, or competitor-led content. People who need your solutions struggle to tell you apart from competitors when you all produce similar content. Surface-level content won’t show a deep understanding of potential buyers.

But data-based storytelling just might.